how to avoid inheritance tax in florida

The federal estate tax exemption for 2021 is 117 million. An estate tax is imposed on the property before it is being transferred to heirs.

Does Florida Have An Inheritance Tax Alper Law

Gift tax helps to plan your estate in Florida.

. How to avoid inheritance tax in florida. If you leave 10 or more. The size of the estate tax exemption means very.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. In the event of your death the assets wont be part of your estate. The internal revenue service announced today the official estate and gift tax limits for 2021.

The estate tax exemption is adjusted for inflation every year. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. The federal capital gains tax is on a sliding scale.

It happens if the inherited estate exceeds the Federal Estate Tax exemption of 1206 million. Put everything into a trust. Inheritances are not considered income for federal tax purposes whether you inherit cash investments or property.

For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. As a result no portion of what you leave to your family will go to. Federal Estate Tax.

The average capital gains tax rate at the state level is around 29 unless you are one of the lucky few living in a state without income taxes. Although the state of Florida does not assess an inheritance tax or an estate levy Florida doesnt charge one. Create an irrevocable trust and transfer your assets into the trust to avoid paying estate taxes.

Florida Inheritance Tax Beginner S Guide Alper Law However if you want to avoid the risks associated with an inheritance loan you may want to consider an inheritance advance. To be subject to inheritance tax someone either inherits assets from a person who lived in a state with the tax or inherited property located in a state with the tax. Florida Inheritance Tax and Gift Tax.

Florida residents are fortunate in. Having multiple partners take ownership of. At the same time the Federal Gift Tax Exclusion has an annual.

This tax is different from the inheritance tax which is levied on money after it has been passed on to the deceaseds heirs. Furthermore no inheritance tax is imposed on estates above 325000 if you leave it to your spouse civil partner a charity or a community amateur sports club. Like most other states Florida does not levy a local gift tax.

However any subsequent earnings on the inherited.

Moving To Avoid Estate And Inheritance Tax Njmoneyhelp Com

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

5 Ways The Rich Can Avoid The Estate Tax Smartasset

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

The Estate Tax Even Worse Than Republicans Say Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax In Florida The Finity Law Firm

What S The Step Up In Basis Worth Ninepoint Advisors

How To Avoid Inheritance Tax Everything You Need To Know

How Many People Pay The Estate Tax Tax Policy Center

What You Need To Know About Estate Tax In Fl

Does Florida Have An Inheritance Tax

![]()

Does Florida Have An Inheritance Tax Alper Law

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

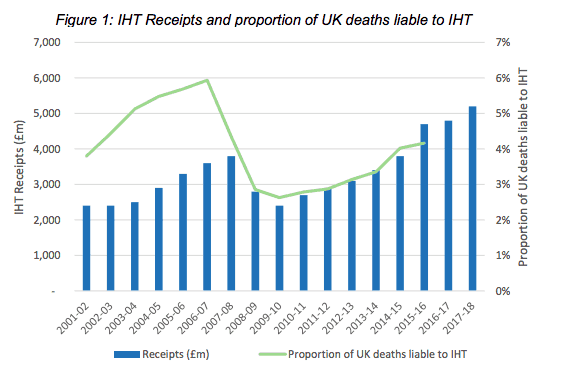

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

State Taxes On Inherited Wealth Center On Budget And Policy Priorities